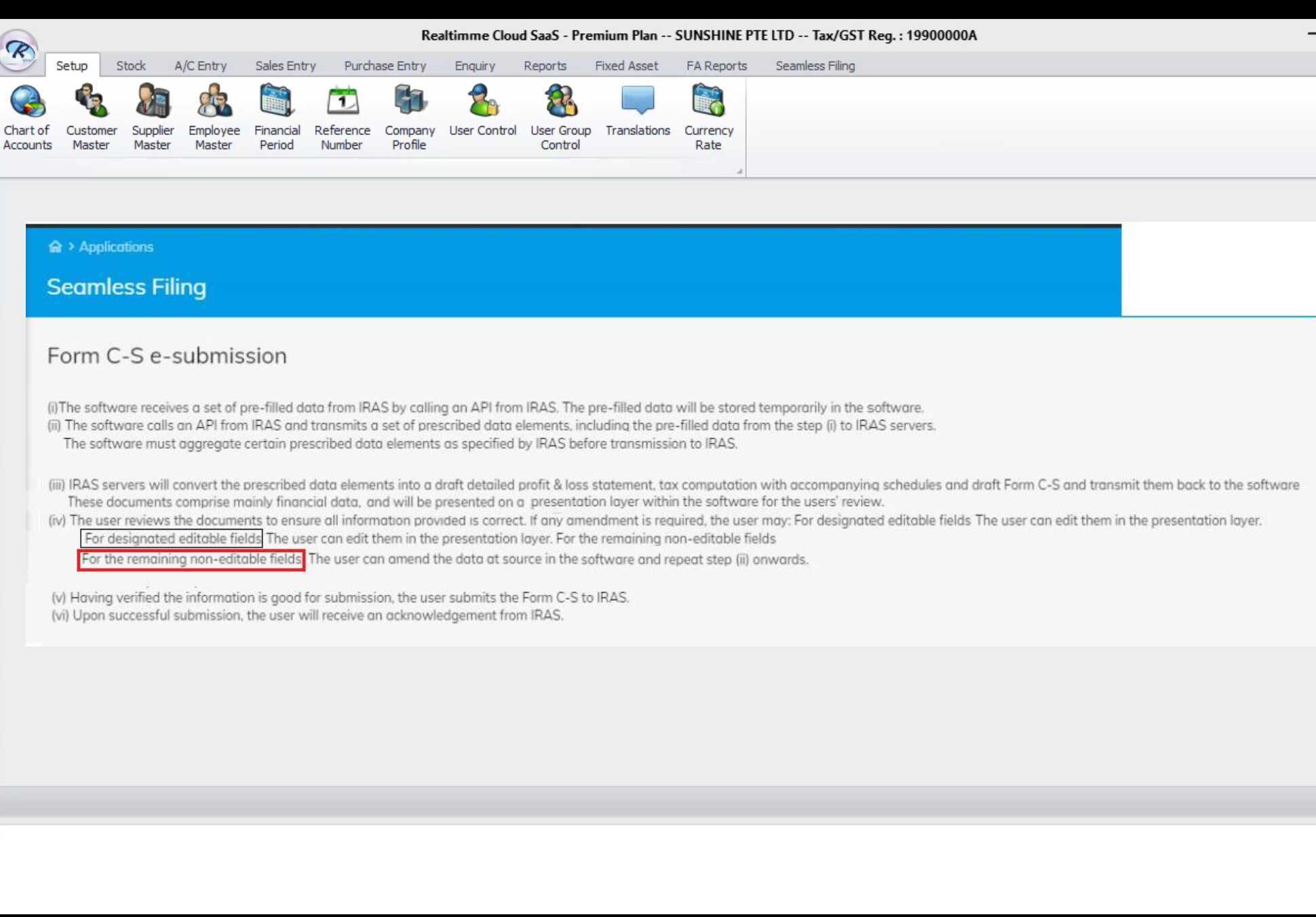

26. Seamless filing - ACRA / IRAS

-

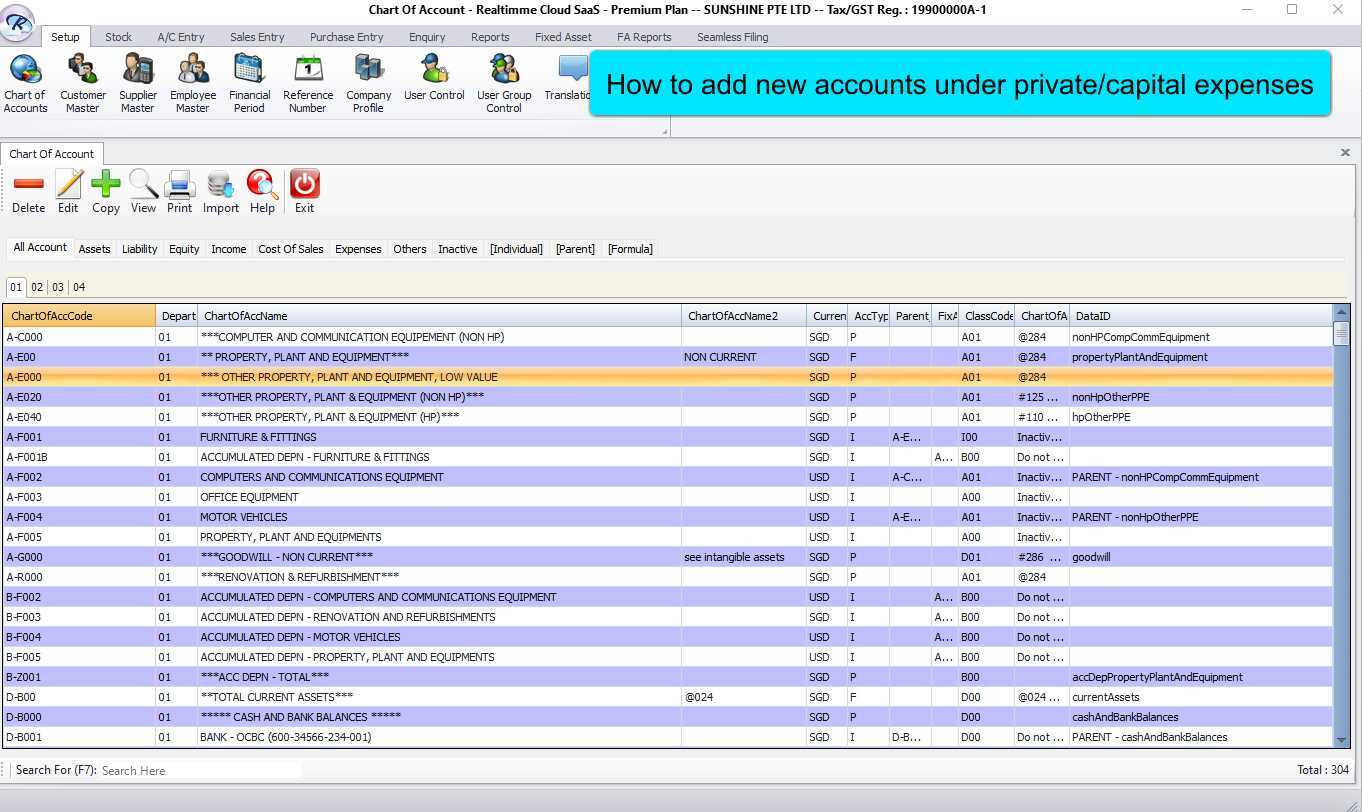

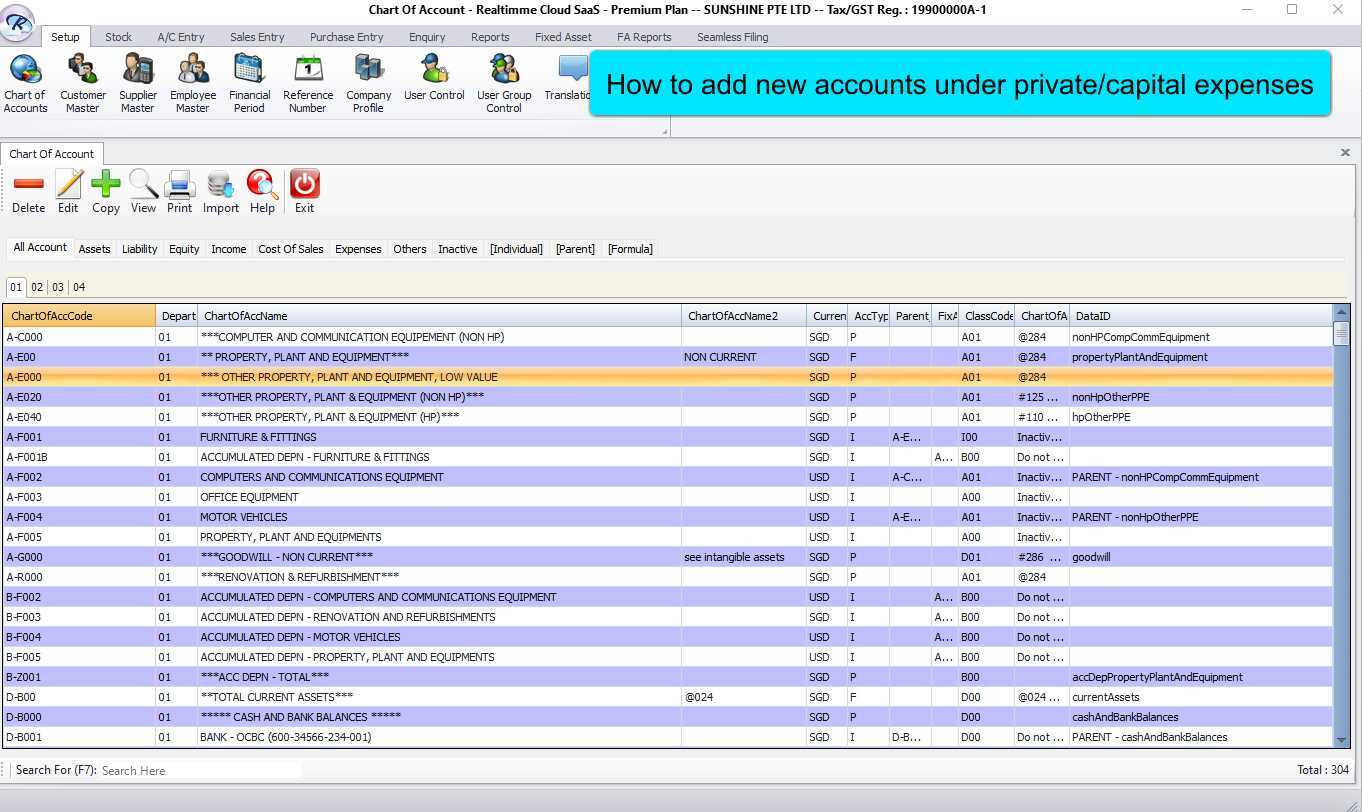

27. Add chart of accounts under private or capital expenses data id

05/02/2023

|

01:34

Learn how to add chart of accounts under private or capital expenses data id for form CS filing

27. Add chart of accounts under private or capital expenses data id

Created:

05/02/2023

-

Step 1/4 : Housekeep Chart of accounts with prescribed data id from ACRA and IRAS

Jul 13, 2022

|

04:33

Learn how to prepare your chart of accounts as part of your system setup

Step 1/4 : Housekeep Chart of accounts with prescribed data id from ACRA and IRAS

Created:

Jul 13, 2022

-

Step 2/4 . Update company information for simplified XBRL filing to ACRA

Jul 13, 2022

|

03:23

If your company is required to file simplified XBRL , learn how to update your company information for annual returns to ACRA

Step 2/4 . Update company information for simplified XBRL filing to ACRA

Created:

Jul 13, 2022

-

Step 3/4: Fixed Asset Register with Capital allowance

Mar 1, 2021

|

01:42

Learn how to record your fixed asset for accounting and corporate tax filing (capital allowances) purposes

Step 3/4: Fixed Asset Register with Capital allowance

Created:

Mar 1, 2021

-

Step 4/4 : Import GL balances brought forward into Realtimme Cloud

Mar 2, 2021

|

03:36

Step 4/4 : Import GL balances brought forward into Realtimme Cloud

Created:

Mar 2, 2021

-

Preset Third, Related and Non Trade Debtors and Creditors

Aug 2, 2020

|

05:54

Preset Third, Related and Non Trade Debtors and Creditors

Created:

Aug 2, 2020

-

26. Add chart of accounts under private or capital expenses data id

01:34

Learn how to add chart of accounts under private or capital expenses data id for form CS filing

26. Add chart of accounts under private or capital expenses data id

-

26. Annual Returns filing to ACRA

Jan 25, 2023

|

05:38

Learn how to submit your annual returns , without financial statement. Solvent and individual shareholders, private dormant relevant company

26. Annual Returns filing to ACRA

Created:

Jan 25, 2023

-

26. ACRA XBRL Submission

Jul 13, 2022

|

03:29

Learn how to run validation, acknowledge and upload XBRL to ACRA

26. ACRA XBRL Submission

Created:

Jul 13, 2022

-

26. Filing form C-S by tax agent

May 1, 2023

|

04:44

Learn how to do filing of corporate tax form C-S , If you are tax agent of your client,

26. Filing form C-S by tax agent

Created:

May 1, 2023

-

26. Filing of Form C-S by non-tax agent (Owner)

Jul 17, 2022

|

04:23

Learn how to file your corporate tax form C-S to IRAS (for business owner or finance officer that is a non tax agent)

26. Filing of Form C-S by non-tax agent (Owner)

Created:

Jul 17, 2022